special tax notice empower

However the 10 additional income tax on early distributions and the special rules for public safety officers do not apply and the special rule described under the section If you were born on or. Special Tax Notice Fact Sheet.

Special Tax Notice Regarding Rollovers.

. Special tax notice regarding plan payments. However if you receive the payment before age 59 12. Purposes of the US.

Empower Retirement refers to the. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. CP504 - Final Balance Due Notice Intent to Levy ACS Letter LT11 - Final Notice and Notice of Intent to Levy and Your Notice of a Right to a Hearing.

3206-0212 Washington DC 20415-0001 Special Tax Notice Regarding Rollovers The statements contained in this notice prepared by the Office of Personnel Management OPM are based upon a. Please consult with Empower Retirement at. Fee Disclosure Notice 20.

Usually it is included along with the distribution form. Special Tax Notice Regarding Retirement. Important CCCERA Refund Tax Information and Special Tax Notice.

Empower and Enable All Taxpayers to Meet Their Tax Obligations. 2022 Qualified Default Investment Alternative Notice 31. Have You Told Your Employees About the Earned Income Credit EIC.

The document has moved here. Please consult with your financial planner attorney andor tax advisor as needed. This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits.

With the first major tax reform of the past generation now a fact of political history the next big idea on the agenda centers on a trillion-dollar infrastructure spending bill that would aim to upgrade Americas frayed transportation and telecommunications systems and stimulate the economy. Contra Costa County Employees Retirement Association. Or 18007018255 regarding tax implications when you request withdrawals from your account.

Special Tax Notice Safe Harbor Explanations Eligible Rollover Distributions. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan.

A9164_402f Notice 0321 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period applies without regard to whether you have had a separation from service. 2020 PFIC Status. Empower Retirement Form for Purchase of Service Credit.

Receiving this does not mean you are eligible for a distribution or that you have requested a distribution. This statement is provided for shareholders who are United States persons for. We will empower taxpayers by making it easier for them to understand and meet their filing reporting and payment obligations.

Post October 7 2020. Empower and Enable All Taxpayers to Meet Their Tax Obligations. A Stable Value Fund for LSERS at Empower Retirement effective 112020.

The Special Tax Notice Regarding Plan Payments explains the tax consequences of taking a distribution from your Plan. Tax contributions through either a direct rollover or a 60-day rollover. 1820513109 Page 3 of 4 the after-tax contributions in all of your IRAs in order to.

Important CCCERA Refund Tax Information and Special Tax Notice. Updated 102020 Your Rollover Options. Post March 8 2018.

If you receive a payment from an IRA when you are under age 59½ you will have to pay the 10 additional. Special tax rules that could reduce the tax you owe. GREENWOOD VILLAGE Colo April 2 2020.

Box 309 Ugland House Grand Cayman KY1-1104 Cayman Islands US Tax ID. Page Last Reviewed or Updated. You must keep track of the aggregate amount of 1820513109 Page 2 of 4.

Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. March 30 2021. Convey information needed before deciding how to receive plan benefits.

SECTION 1 - 402f NOTICE 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement savings in your retirement plan the Plan and contains important. United States Office of Personnel Management Form Approved Retirement Operations OMB No. If I Do a Rollover To An IRA Will the 10 Additional Income Tax Apply To Early Distributions From the IRA.

Our staff provides consistent and timely answers to all your questions. Shareholders of Empower Ltd. Special Tax Notice Regarding Your Rollover Options.

It explains when and how you can continue to defer federal income tax on your retirement savings when you receive a distribution. We help you navigate through administrative issues products and the complicated tax code to provide a variety of solutions. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

Rollover instructions and form. Notice of Your Rights Concerning the JPMorgan Chase Common Stock Fund Under the JPMorgan Chase 401k Savings Plan 30. SECTION 1 - 402f NOTICE.

Our approach to the Employee Benefits market is to provide your business options and solutions to benefit the employees that you are looking to reward. Empower Retirement Form for Purchase of Service Credit. Income tax on early distributions from the IRA unless an exception applies.

IMPORTANT TAX NOTICE. We continue to add and enhance tools and support to improve taxpayers and tax professionals interactions with the IRS on whichever channel they prefer. CP503 - Individual Balance Due Second Notice.

You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan. The Manager Taxation Tax Controversy Modelling and Special Projects manages tax controversy matters including federal and state tax examinations and notice responses and documenting of. ACS Letter LT19 - Pay Your Outstanding Tax Returns.

2022 Notice of Automatic Enrollment 28. Employment Tax Notices. We are deeply sorry for your loss.

Death During Active Membership Form 104 Read more. ACS Letter LT17 - Please Take Action on your Balance Due Using our Online Services. 1200 Concord Avenue Suite 300 Concord CA 94520.

Get to know the IRS its people and the. Footer link May 26 2015. This notice is provided to you.

Deposit Requirements for Employment Taxes PDF. Death During Active Membership Form 104 Read more.

Printable Emergency Contact Form Template Emergency Contact Form Student Information Sheet Student Information

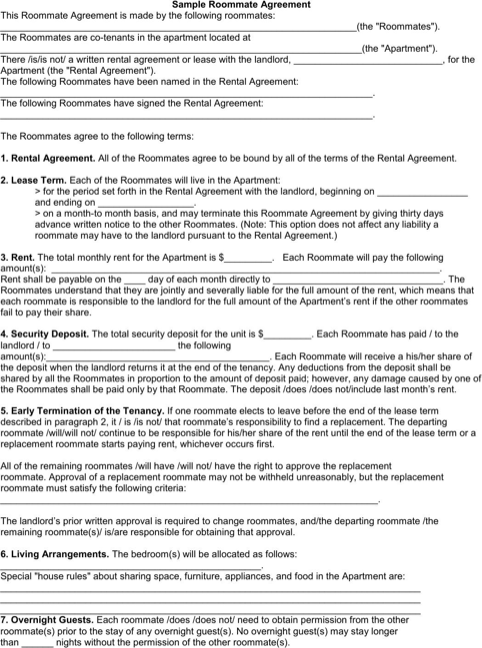

Roommate Agreement Rental Agreement Templates Room Rental Agreement Roommate Agreement

Free Termination Letter Template Introduction Letter Letter Templates Lettering

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions Power Of Attorney Form Power Of Attorney Job Application Template

Board Of Directors Resume Example Page 2 Resume Examples Resume Skills Board Of Directors

Certificate Of Origin For A Vehicle Template Beautiful Motor Vehicle Certificate Of Payment Of Sales Or Use Tax

This Guy Post Yoga Mat For Sale Ad On Craigslist And It Is Beyond Hilarious Newslinq Funny Yoga Memes Yoga Funny Yoga Mats For Sale

Get Our Example Of Rental Deposit Refund Letter Sample Receipt Template Being A Landlord Letter Templates

A Notice Of Assessment Or Noa Is A Statement From The Canada Revenue Agency Notifying The Taxpayer Of The Amount Of Tax They Assessment Tax Credits Income Tax

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W4 Tax Form Tax

Application For Employment Employment Application Job Application Employment Form

Student Emergency Contact Printable Form Template Emergency Contact Form Student Information Sheet Student Information